Senate Committee Stalls Vote on Trump’s CFTC Nominee

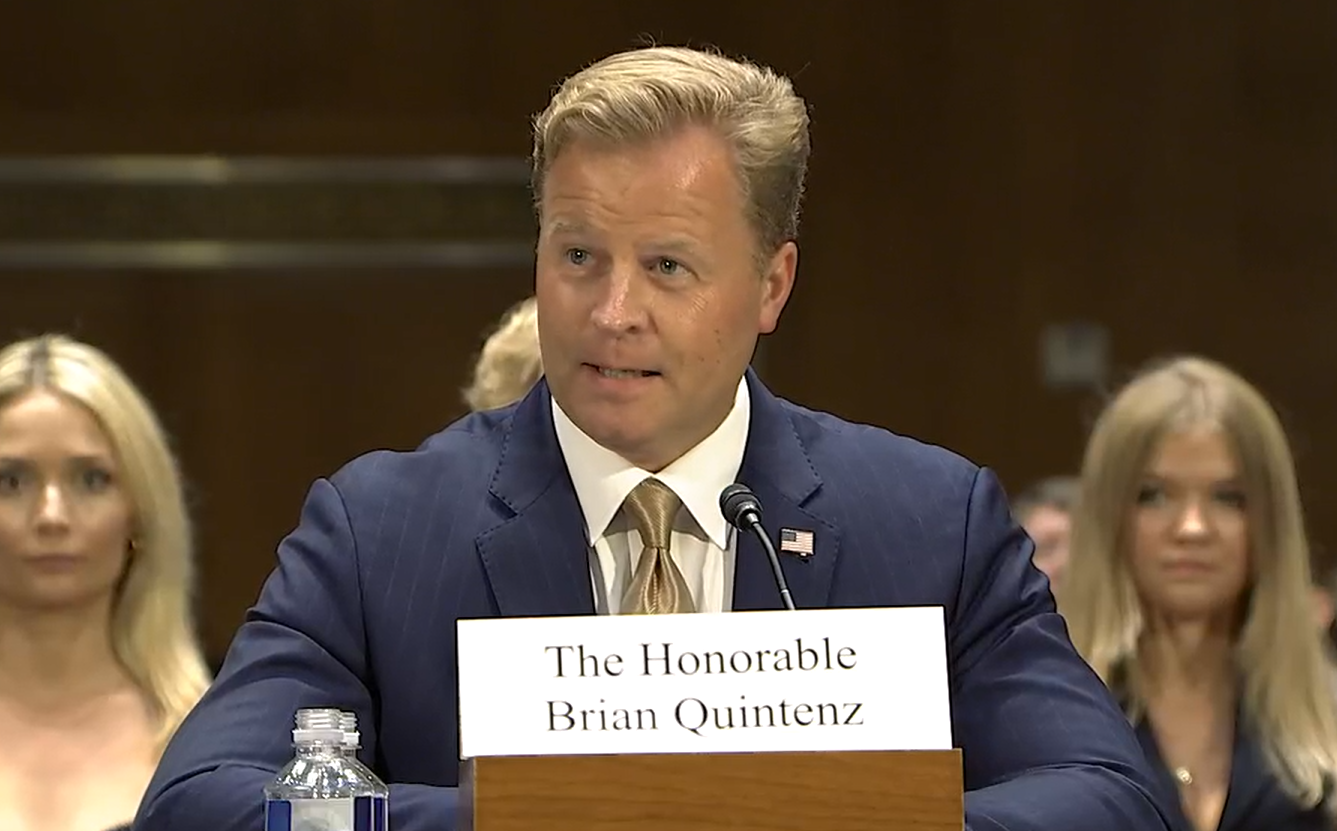

In a surprising turn of events, a Senate committee postponed its vote on President Trump’s selection of Brian Quintenz for the chairmanship of the Commodity Futures Trading Commission (CFTC). This latest development adds another layer to the ongoing debate about the government’s role in regulating prediction markets.

Initially, the Senate Committee on Agriculture, Nutrition, and Forestry had indicated that Quintenz would be among four nominees scheduled for a vote on Monday. However, later that day, his name was abruptly removed from the agenda. Sources close to the situation revealed that the delay was likely due to travel difficulties faced by Senator Cindy Hyde-Smith of Mississippi. The absence of Republican votes without her presence could have jeopardized the nomination’s progression. The committee is now planning a meeting to ensure the nomination moves forward prior to the August recess.

This postponement is particularly significant given the contentious discussion surrounding the impact of federal regulations on the sports wagering industry, especially following the pivotal PASPA ruling. Since 2018, the federal CFTC has been navigating the complicated landscape of prediction markets, which involve betting on sports outcomes, an area that many states have begun regulating independently.

Concerns Over Federal Authority and Tribal Sovereignty

Quintenz, who previously served as a CFTC commissioner until August 2021, is poised for another leadership role within the agency. In a recent confirmation hearing, he faced tougher questions from Democratic senators, including Adam Schiff and Cory Booker, regarding potential overreach of federal authority in regulating sports events. Schiff directly questioned whether the CFTC should prohibit contracts that might infringe on tribal sovereignty, a concern especially pertinent in California, which hosts numerous federally recognized tribes reliant on gaming revenues.

A Debate Over Market Functions and Federal Legislation

In addressing the concerns, Quintenz asserted that the CFTC must adhere to the Commodity Exchange Act (CEA) of 1936, which governs commodity trading. He argued that derivatives markets play a critical role in risk management and price discovery, which he believes even applies to event contracts tied to sports outcomes.

The subject sparked vibrant discussions at the recent National Council of Legislators From Gaming States meeting in Louisville. There, conflicting views emerged about whether prediction markets should be classified as financial instruments or as illegal wagers. Attorney Michael Hoenig argued vehemently that these contracts undermine tribal sovereignty, while Josh Sterling, representing Kalshi, countered that no explicit legal prohibition exists against them.

Calls for Clarity in Regulation

Amidst this backdrop, a coalition of national, state, and tribal organizations recently urged senators to postpone the vote on Quintenz’s nomination. This group, which includes the American Gaming Association, contends that he has failed to provide adequate answers to pressing questions regarding the legality of sports event contracts. They argue that these contracts could potentially violate both state and federal laws without any comprehensive review from the CFTC.

Bill Miller, the AGA president, emphasized the need for state-level regulation of sports event contracts, drawing parallels between these derivatives and traditional wagers. He pointed out that at their core, these contracts serve the same purpose—betting on the outcome of a sporting event.

As this debate unfolds, the future of how prediction markets and sports event contracts will be regulated remains uncertain, particularly with an important vote on Quintenz’s nomination looming before the Senate adjourns for the summer.