Playtech Exits B2C Landscape as HappyBet Transferred to NetX Betting

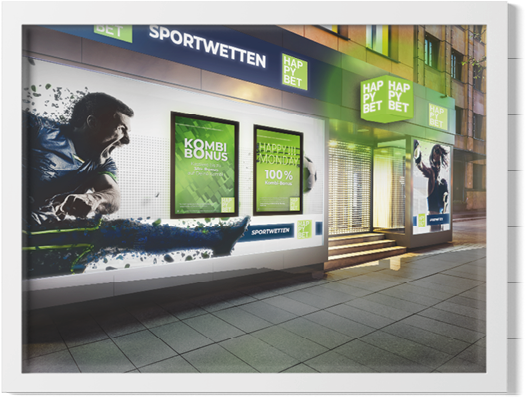

In a significant move marking its transition away from business-to-consumer (B2C) operations, Playtech has sold its German brand HappyBet to NetX Betting, a subsidiary of Pferdewetten AG. This announcement was made on Wednesday, following the company’s initiation of the sales process for HappyBet just two months prior.

This deal not only bolsters Pferdewetten’s presence in the retail sports betting sector but also highlights the company’s strategy for growth, as stated in their official release.

In its financial report for 2024, Playtech revealed that the HappyBet segment faced an adjusted EBITDA loss of €11.8 million, attributed to rising operational costs. Despite a slight revenue increase of 4% to €18.9 million, challenges remain evident. During the previous year, Playtech took the step of shuttering HappyBet’s operations in Austria, indicating a readiness to exit the German market if a buyer was not found.

Transition and Integration Plans for HappyBet

As part of the acquisition, horseshoes for HappyBet shops will be allowed to engage with franchise partners, transitioning these operations to operate under Pferdewetten’s Sportwetten.de brand. The deal also encompasses around 600 hardware units, such as betting kiosks and point-of-sale systems, although financial specifics of the transaction were not disclosed.

To ensure a smooth transition, a designated period has been established for Pferdewetten to finalize arrangements with franchise partners and secure necessary approvals from German regulators. Any remaining assets from HappyBet that aren’t transferred will be ultimately liquidated.

Pierre Hofer, CEO of Pferdewetten, projected that within three months, an estimated mid-double-digit number of shops will be integrated into their network, which could yield an additional annual revenue of about €7 million and contribute positively to EBITDA by over €1 million.

Playtech’s Strategic Shift towards B2B Operations

The divestiture of HappyBet aligns with Playtech’s strategic pivot towards a pure-play business-to-business (B2B) framework. Previously, the company divested its Snaitech operations in Italy to Flutter Entertainment for approximately €2.3 billion, a move that Playtech described as pivotal for shareholder value.

This streamlined business model is expected to enhance Playtech’s technological capabilities, broaden its client base, and improve existing customer engagement. With the sale of Snaitech, Playtech announced plans for a significant special dividend to its shareholders, reinforcing its commitment to maximizing shareholder value.

Snaitech, which played a crucial role in Playtech’s growth trajectory, was integrated with HappyBet in 2021. HappyBet was among the first to be granted a federal sports betting license in Germany back in October 2020.

On the stock market, Playtech shares saw a slight decline of 0.93%, trading at 319.50 pence each in London. In contrast, Pferdewetten AG’s shares witnessed a surge of 6.83%, reaching €2.97 in Frankfurt, marking a positive response amidst the transition.