Upcoming CFTC Engagement Offers Tribal Leaders a Chance to Address Prediction Markets

On Thursday, tribal leaders from across the United States are set to convene virtually with Caroline Pham, the acting chair of the Commodity Futures Trading Commission (CFTC). This meeting, shrouded in uncertainty, will primarily focus on contracts related to prediction markets in sports events—a topic that remains somewhat of a mystery, even to participants.

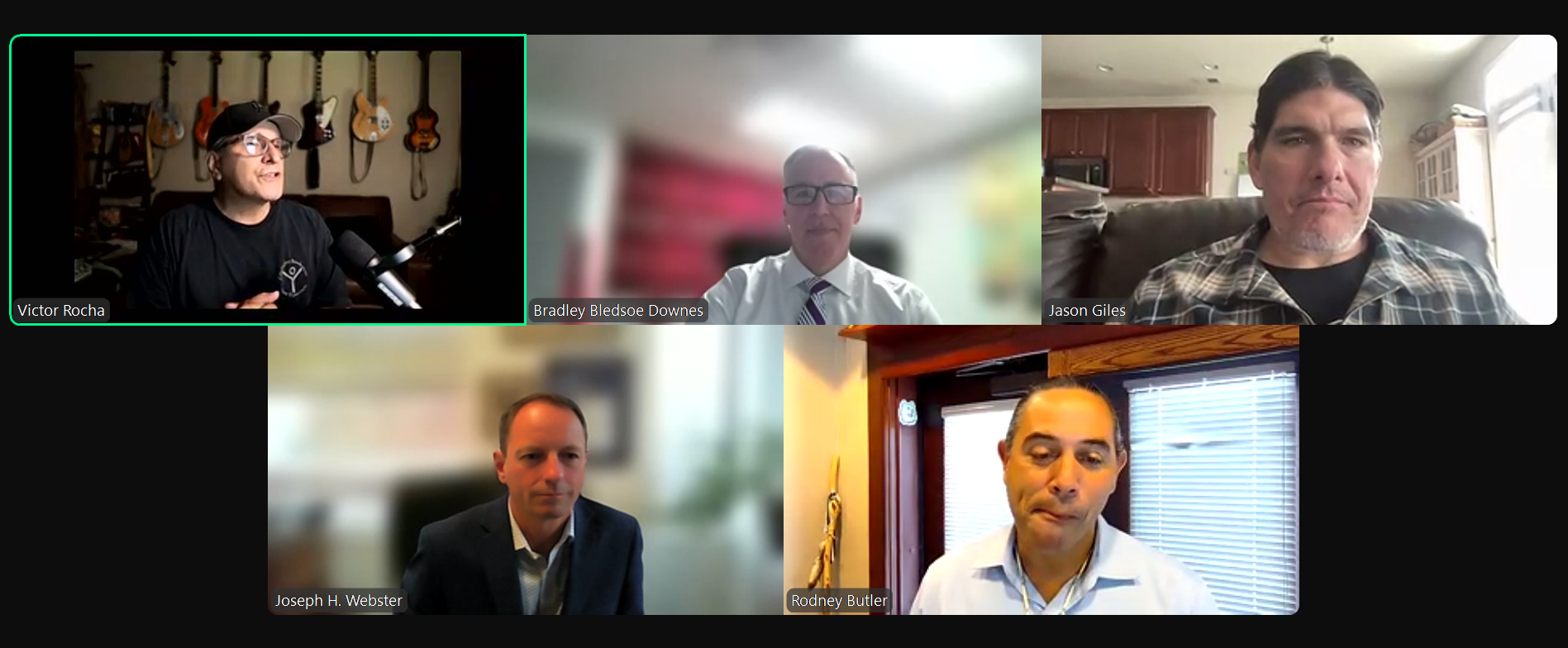

In preparation for this discussion, Victor Rocha and Jason Giles from the Indian Gaming Association hosted a webinar as part of their New Normal series. The featured guests were notable figures, including tribal attorneys Bradley Bledsoe Downes and Joseph Webster, along with Rodney Butler, chairman of Connecticut’s influential Mashantucket Pequot Tribal Nation.

The consensus among the panelists was that they possess little insight into what the CFTC’s communication will entail. Earlier, the CFTC had planned an extensive meeting in Washington, D.C., which was later canceled without public explanation, leading to further speculation regarding the upcoming call.

Downes expressed his frustration, stating, “All we’ve received is an invitation.” He suggested that the upcoming meeting feels somewhat performative—a mere formality.

Butler Raises Alerts on Compact Violations

Rodney Butler’s remarks were particularly striking, as he underscored his status as a significant voice within the tribal gaming community. His tribe, along with the Mohegan Tribe, has a gaming compact with Connecticut, which secures them exclusive gaming rights in exchange for substantial revenue contributions to the state.

Butler warned that the emergence of prediction markets poses a threat to these agreements: “It’s simple: they’re violating our compacts, undermining the government-to-government relationships we’ve painstakingly built.” Currently, Connecticut has yet to join other states in issuing cease-and-desist orders to prediction markets such as Kalshi and Crypto.com. However, Butler noted that the state’s attorney general is investigating the situation.

“Tribal exclusivity agreements are lucrative, and we need to safeguard these arrangements,” he remarked.

Legal Landscape and Prediction Markets

During the webinar, Downes and Webster provided an overview of ongoing litigation involving prediction markets. Kalshi, in particular, is engaged in legal disputes across multiple states including Nevada and New Jersey. While it has obtained preliminary injunctions in these cases, appeals are on the horizon, and the Maryland case shows promise for robust legal scrutiny.

As legal battles unfold, interest from commercial entities is rising, with organizations such as the Nevada Resort Association seeking to intervene in the Nevada appeal. This growing involvement hints at a broadening coalition against the expansion of prediction markets.

Webster highlighted the absence of tribal representation in these legal discussions, emphasizing that no comprehensive rulings have been established yet by the courts.

The CFTC Under the Microscope

The webinar participants turned their focus to the CFTC, an agency experiencing unprecedented scrutiny amid the rise of prediction markets. Historically associated with niche commodities, the CFTC is now confronted with the prospect of regulating sports betting through prediction markets—a role it has shown reluctance to embrace.

Downes noted that the process allowing prediction markets to self-certify their contracts without prior approval from the CFTC might be being exploited. This system raises concerns about regulatory oversight for exchanges like Kalshi.

Amid ongoing changes within the CFTC, including recent resignations, the agency’s future direction remains uncertain, adding another layer of complexity to the issue.

Kalshi’s Visibility and Controversies

As developments unfold, Kalshi has not shied away from the spotlight. A recent incident involving California gubernatorial candidate Kyle Langford, who recently purchased contracts betting on his own election, has raised questions about electoral integrity. Kalshi’s representatives have stated they are monitoring this situation closely and investigating any potential violations.

Additionally, Kalshi CEO Tarek Mansour captured attention by asserting that mainstream financial services would soon offer Kalshi markets, bolstering the claim that prediction markets are legitimate financial instruments.

Interestingly, Kalshi drew headlines earlier this month with an announcement of a partnership with Elon Musk’s xAI, only to retract it hours later, leading to speculation about the motivations behind such collaborations.

As the landscape of prediction markets continues to evolve, tribal leaders are keenly aware of the implications for their sovereign rights and economic interests. The outcomes of the CFTC meeting could greatly influence the future of gaming agreements and the integration of prediction markets into the broader betting ecosystem.