Bally’s All Set for a Bronx Casino: A Look at Recent Developments

In an impressive display of legislative momentum, Bally’s Corporation has successfully garnered significant support to advance its ambition of establishing a casino in the Bronx, New York. Key legislative measures were passed last Friday, paving the way for the company to vie for one of three coveted downstate casino licenses.

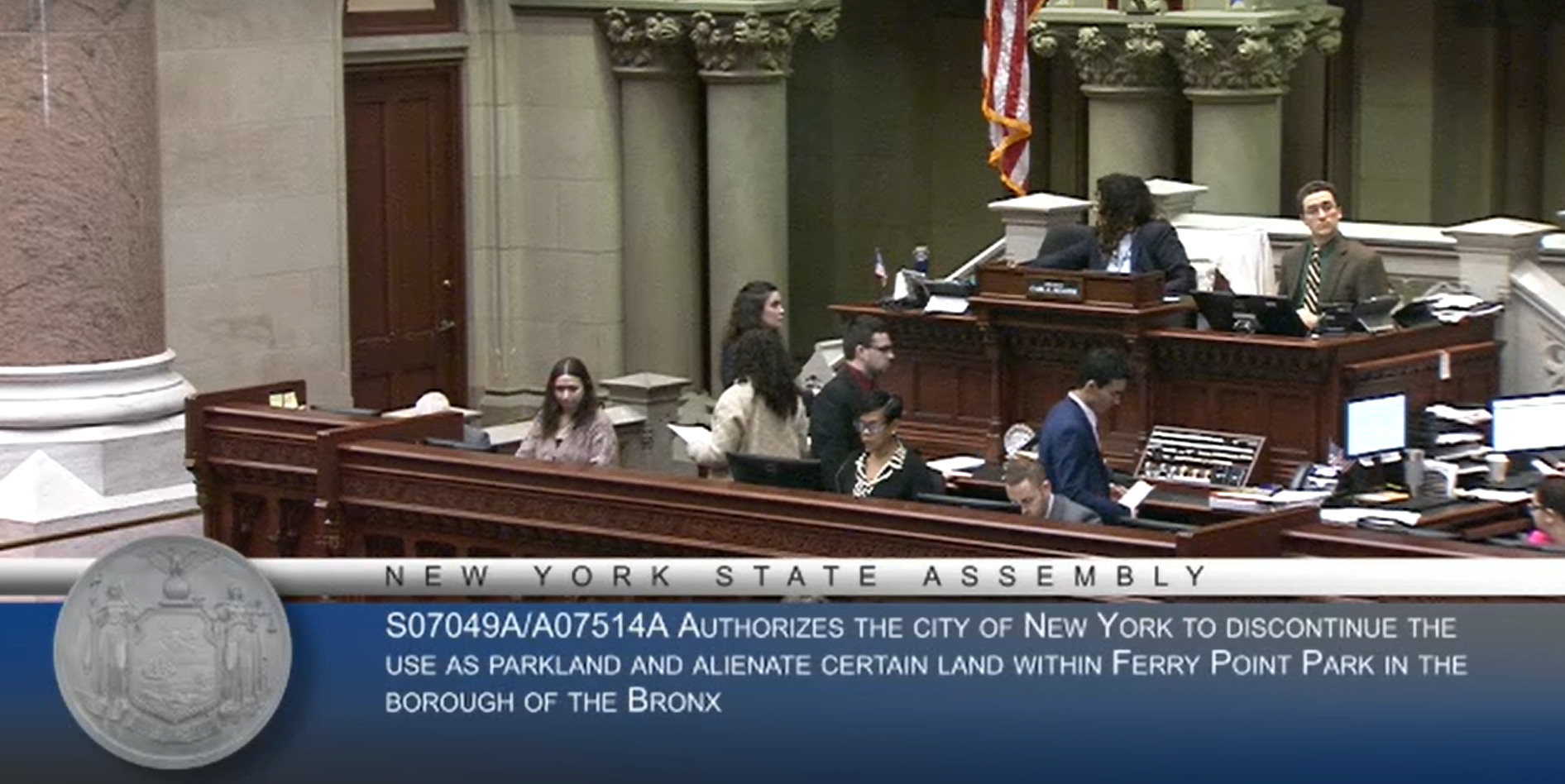

The New York State Senate, led by Senator Nathalia Fernandez, approved essential rezoning legislation, Senate Bill S7049A, with a decisive 55-4 vote. Shortly afterward, Assemblyman Michael Benedetto’s Assembly Bill 7514 proceeded smoothly through the assembly, receiving overwhelming backing with a 132-2 vote. With only Governor Kathy Hochul’s signature required, Bally’s is poised to meet the crucial bid submission deadline of June 27.

The proposed $4 billion casino-resort aims to transform the Bally’s Links golf course in Ferry Point, conveniently located near the Whitestone Bridge. Despite facing local criticism linked to its acquisition of the site from the Trump Organization, the rapid progress of the legislative approvals highlights Bally’s determination and strategic planning.

Approaching Deadline: The Licensing Landscape

As the June deadline looms, the landscape of casino bids in New York is evolving. Initially, 11 substantial proposals were in the race, but that number has shrunk to eight, with only two bids — existing racinos in Yonkers and Queens — fully prepared for submission. Both Bally’s Bronx project and Steve Cohen’s Metropolitan Park proposal in Queens have successfully navigated their necessary zoning approvals, awaiting Governor Hochul’s final endorsement.

Hochul’s recent public appearance at the Belmont Stakes raised questions about her position regarding these proposals, as her office declined media inquiries regarding the ongoing bid processes.

Environmental Reviews and Local Concerns

Several Manhattan proposals, including developments from Caesars in Times Square and Silverstein Properties’ Avenir, are currently undergoing environmental assessments. These reviews must conclude by September 30, per state regulations. Meanwhile, the Coney Island initiative led by Thor Equities faces challenges as it requires city council approval for a critical de-mapping application, which was recently tabled without a vote following community feedback.

The next subcommittee meeting scheduled for June 26 — just one day before New York’s application deadline — could be crucial in determining the fate of the Coney Island project.

Bally’s: Juggling Multiple Projects

While Bally’s focuses on its Bronx ambitions, the company has multiple irons in the fire. Its Chicago casino, a $1.8 billion investment, is under construction and must open by September 2026. After a recent halt due to regulatory issues, work has resumed, bringing renewed hope for completion.

In addition, Bally’s is exploring plans for a new property on the Las Vegas Strip near the upcoming ballpark for the Las Vegas A’s. The recent implosion of the Tropicana has set the stage for this new development, with scant details available thus far.

Bally’s acquisition of Australian gaming operator Star Entertainment for AU$300 million, alongside partner Bruce Mathieson, signals its commitment to growth amid ongoing federal inquiries into anti-money laundering practices and mounting scrutiny from regulatory bodies.

Financial Considerations: Can Bally’s Sustain Its Ambition?

Amid this flurry of activity, questions remain about Bally’s ability to finance such ambitious projects. With a hefty $500 million upfront licensing fee for the New York venture, plus additional financial obligations tied to its relationship with the Trump Organization, the costs are substantial. As of Q1, Bally’s reported cash reserves of $209 million against total debt of $3.43 billion. The uncertainty surrounding its shares, which have dropped over 50% this year, adds another layer of challenge to its ventures.

In summary, while Bally’s has made significant strides in its quest for a New York casino, the coming weeks will be telling as it navigates financial constraints and regulatory landscapes to capitalize on its ambitious plans.