Bright Horizons for Prediction Markets: Insights from Recent Senate Hearing

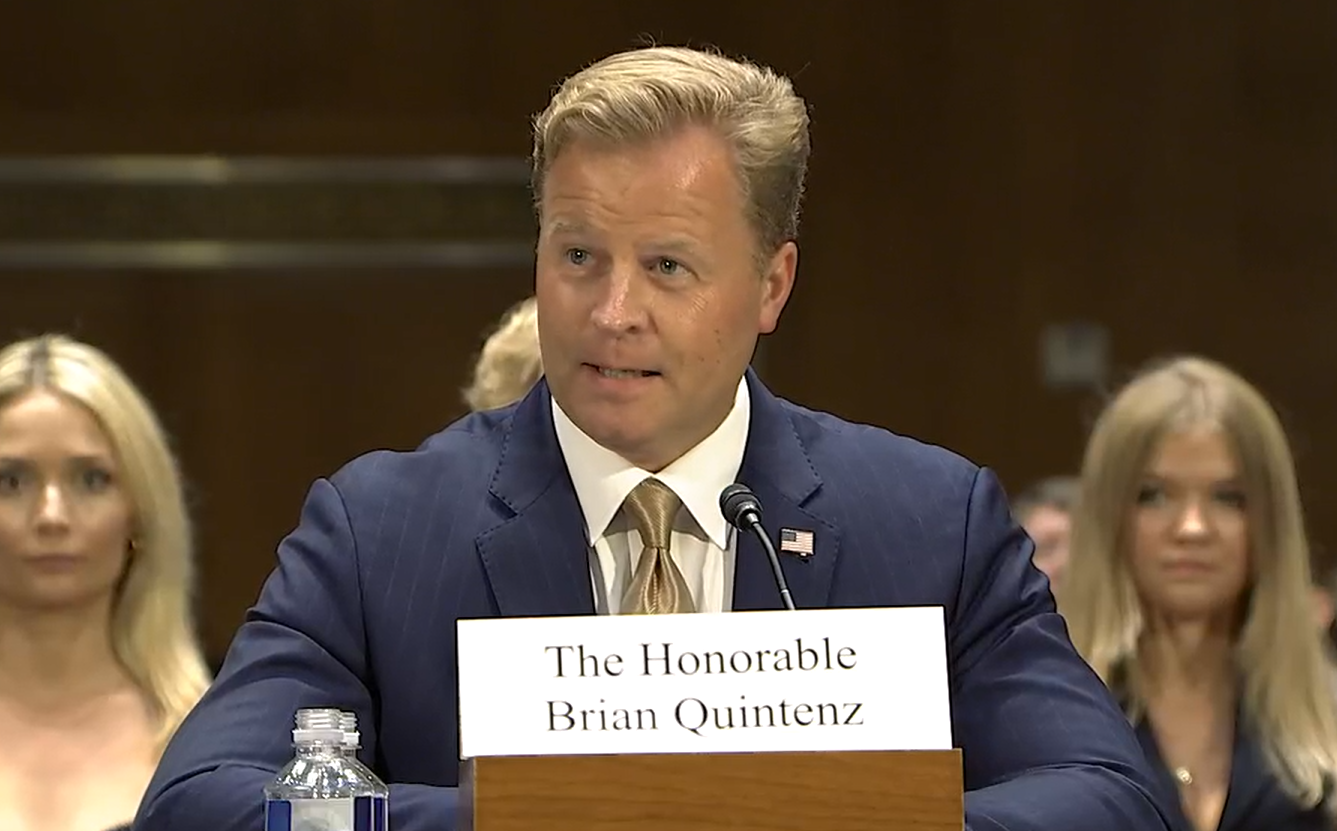

On Tuesday, the U.S. Senate Committee on Agriculture, Nutrition, and Forestry conducted an anticipated confirmation hearing for Brian Quintenz, nominated to chair the Commodity Futures Trading Commission (CFTC). This agency, once viewed primarily as a niche derivatives regulator, now finds itself at the center of attention due to the surging popularity of prediction markets.

During the 49-minute hearing, senators rigorously questioned Quintenz—who served on the CFTC from 2017 to 2021—covering a diverse range of topics. His responses highlighted the expansive reach of the commission, particularly as it relates to prediction markets.

A key focus for gaming stakeholders was Quintenz’s perspective on prediction markets, especially since the introduction of sports contracts, which have disrupted existing frameworks around state gaming rights. These developments present a federally sanctioned alternative adjacent to traditional sports betting.

In 2021, while still on the CFTC, Quintenz openly supported sports contracts as legitimate commodities, distinguishing himself from the majority opinion. His position remains firm; he reiterated it during the hearing.

In response to queries about tribal gaming rights from California Senator Adam Schiff, Quintenz maintained that the law is explicit regarding the classification of events with economic consequences as commodities under the Commodities Exchange Act (CEA). He emphasized this in conjunction with the ongoing debate surrounding tribal gaming and prediction markets, notably following the CFTC’s discussions with tribal leaders earlier this year.

Quintenz assured Schiff that he would engage with all stakeholders, including tribal representatives, although he suggested no immediate changes to the current trajectory of prediction markets were planned.

The hearing also brought to light Quintenz’s role in the cryptocurrency and prediction market sectors, raising concerns about potential conflicts of interest. He assured the committee of his commitment to ethical standards and pledged to divest any holdings conflicting with his future responsibilities.

A significant discussion point was the self-certification process for prediction markets, contrasting it with traditional gaming regulatory approaches. While some critics argue that this system allows exchanges like Kalshi to exploit loopholes, Quintenz defended it as a necessary mechanism for fostering market efficiency. He pointed to a dramatic increase in the range of futures contracts since self-certification was introduced.

Evaluating the implications of the hearing reveals complex dynamics for the future of legal sports betting. While prediction markets could become a viable option for sportsbooks, external factors like court rulings or legislative changes could disrupt their growth. Thus, potential investments carry inherent risks.

DraftKings’ recent move to withdraw an application for its prediction market prototype, alongside Flutter’s strategic staffing transitions toward exploring exchange possibilities, reflects the calculated caution in this evolving landscape.

Moreover, the growing uncertainty in the regulatory environment, highlighted by increasing taxes and restrictive legislative proposals, complicates the market landscape. Among only a few designated contract markets currently available, the entry of numerous exchanges could lead to market saturation.

As prediction markets, DFS innovations, social sportsbooks, and other adjacent developments reshape the landscape, the coming years will demand adaptability. This moment in history stands as one of the most exhilarating eras for bookmakers since the repeal of PASPA, filled with both opportunities and uncertainties.